Punjab & Haryana High Court Quashes ₹6.63 Lakh Pension Recovery, Orders Refund with Interest

Landmark ruling establishes that pension deductions require explicit consent, directs RBI to issue guidelines to all banks

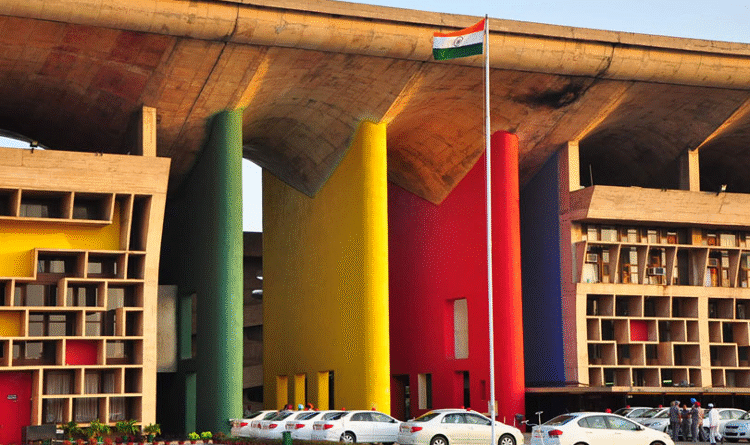

CHANDIGARH, November 4 – In a significant judgment safeguarding the rights of retired government employees, the Punjab and Haryana High Court has quashed an order that upheld the recovery of ₹6,63,688 from a pensioner’s account and directed its immediate refund with 6% annual interest.

Justice Harpreet Singh Brar, delivering the verdict in the case of Sajjan Kumar Goyal versus State of Haryana, ruled that the recovery made on March 31, 2021, was illegal as it was effected without the pensioner’s knowledge, consent, or any prior notice.

Goyal, who retired as Executive Officer from Municipal Council, Kaithal in February 2016, discovered that over ₹6.63 lakh had been deducted from his personal bank account by Punjab National Bank with the transaction marked as “Recovery of Excess Pension.” The authorities later justified this by claiming a clerical error had resulted in double payment of Dearness Allowance from April 2019 to February 2021.

The court observed that under both the Punjab Civil Services Rules and Haryana Civil Services (Pension) Rules, 2016, no recovery can be made from a sanctioned pension without the express written consent of the pensioner. “The petitioner was neither served with any notice nor afforded an opportunity of hearing prior to the recovery being effected, rendering the entire action in teeth of the principles of natural justice,” Justice Brar stated.

In a stern rebuke of the unilateral action, the court noted that such arbitrary recoveries “undermine the very object of providing pension to retired employees” and cause severe financial and emotional hardship to pensioners who depend entirely on their monthly income for essential expenses.

The judgment extensively cited Supreme Court precedents, particularly the landmark case of State of Punjab v. Rafiq Masih (2015), which held that recovery from retired employees is impermissible in law without consent, especially when excess payment resulted from departmental errors rather than employee fraud or misrepresentation.

Justice Brar emphasized that the rules governing Goyal’s pension were those in force at the time of his retirement in 2016, not subsequent regulations. The court found that the respondent authorities’ own clerical error in calculating pension could not be used to justify recovery without due process.

In a directive with far-reaching implications, the High Court ordered the Reserve Bank of India to issue appropriate instructions to all agency banks, clarifying that no recovery of excess pension amounts shall be effected without the pensioner’s knowledge, consent, and prior notice.

The state government has been directed to refund the recovered amount within three months of receiving a certified copy of the order. The court noted that while legal remedies may exist for the government, “administrative prudence demands that any recovery from pension be preceded by due notice, consultation, and empathetic handling consistent with the dignity of the retired employee.”

Legal experts view the judgment as a watershed moment in pension jurisprudence, establishing clear safeguards against arbitrary administrative actions that have plagued numerous retired government employees across the country.

The ruling comes at a time when several similar cases of pension recovery without consent are pending before various High Courts, and is expected to set a strong precedent for protecting pensioners’ rights nationwide.

Case Reference: CWP-32661-2024, Punjab and Haryana High Court