India-US Trade Deal: Markets Soar as Farmers Raise Alarm Over Agriculture Access

Nifty surges 2.5% on tariff relief, but opposition warns of threats to 70% of India’s population dependent on farming

NEW DELHI, February 3, 2026 – Indian stock markets witnessed a spectacular rally on Tuesday following the announcement of the India-US trade agreement, with benchmark indices surging over 2.5 percent even as farmer leaders and opposition parties raised serious concerns about potential impacts on the agricultural sector.

Markets Celebrate Tariff Cuts

The BSE Sensex closed at 83,739.13, up 2,072.67 points or 2.54 percent, while the NSE Nifty 50 settled at 25,727.55, gaining 639.15 points or 2.55 percent. At the peak of intraday trading, the Sensex had soared by over 4,200 points as investor sentiment turned decisively positive.

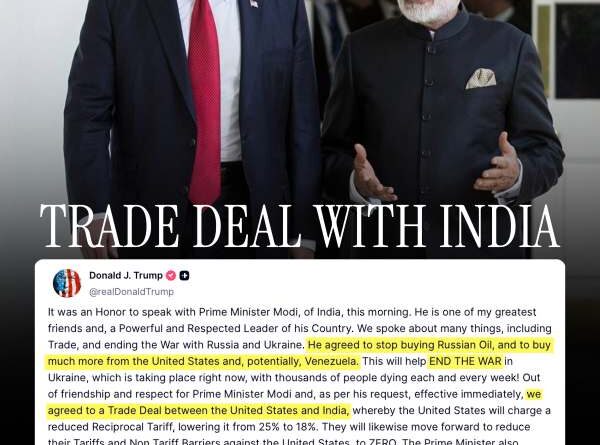

The trade agreement, finalized between US President Donald Trump and Prime Minister Narendra Modi, reduces reciprocal tariffs on Indian goods from 50 percent to 18 percent. The US had previously imposed a 25 percent base tariff plus an additional 25 percent penalty for India’s purchases of Russian oil.

“This breakthrough is unequivocally positive for exports, sentiments and financial markets,” said Radhika Rao, senior economist at DBS Bank. The Nifty Auto index ended 2.8 percent higher, while banking and information technology indices closed up 2.4 percent and 1.4 percent respectively.

Export-oriented sectors are expected to benefit significantly. According to market analysts, textiles, gems and jewellery, engineering goods, leather, pharmaceuticals, and chemicals are likely to see immediate gains from the improved tariff competitiveness.

Goldman Sachs analysts predict India’s current account deficit could narrow by around 0.25 percent of GDP in 2026 to 0.8 percent, with potential rupee appreciation if capital flows return. The brokerage noted downside risk to its current USD/INR forecast of 94.

The Deal Structure

Under the agreement, India has committed to purchasing over $500 billion worth of US energy, technology, agricultural products, coal, and other goods. Trump announced that India would stop buying Russian oil and increase purchases from the US and potentially Venezuela.

Prime Minister Modi confirmed the tariff reduction, stating on social media platform X: “Wonderful to speak with my dear friend President Donald Trump today. Delighted that Made in India products will now have a reduced tariff of 18 per cent.”

The 18 percent rate places India in a more favorable position compared to regional competitors like Pakistan (19 percent), Vietnam, and Bangladesh (20 percent each).

Farmers Sound Warning Bell

However, the euphoria in financial markets stands in stark contrast to growing anxiety in India’s agricultural heartland. Farmer leader Rakesh Tikait, national spokesperson of Bharatiya Kisan Union, has termed the trade deal as “the biggest blow to 70 percent of India’s population.”

According to media reports, Tikait warned that the agreement could increase difficulties for Indian farmers and pose a major threat to the rural economy. His concerns center on potential market access commitments for US agricultural products that could undermine domestic farmers’ livelihoods.

Samajwadi Party chief Akhilesh Yadav launched a scathing attack on the Modi government, calling the deal “a betrayal of the 70 percent population dependent on agriculture.” He alleged that opening India’s agricultural market to American products would create a new class of middlemen and profiteers, potentially driving up food prices while reducing farmers’ incomes.

“This will force farmers deeper into debt, compelling them to sell their land to large corporates,” Yadav warned, characterizing the BJP as “always acting as an agent for foreign powers.”

The Congress party has also raised serious questions about the deal’s impact on agriculture and dairy sectors, demanding that the government disclose all terms in Parliament.

Government Assurances

Responding to these concerns, government sources have categorically denied any compromise on farmers’ interests. Officials told India Today that agriculture and dairy remain protected sectors where existing safeguards will continue.

“There has been no compromise on the interests of farmers during the negotiations,” a government source emphasized. “The existing protection for agriculture and dairy sectors remains fully intact, and no provisions affecting farmers’ livelihoods or the rural economy have been accepted.”

Commerce and Industry Minister Piyush Goyal stated that the trade deal would unlock “huge opportunities for farmers, MSMEs, entrepreneurs and skilled workers” while providing a major boost to the Make in India initiative.

Finance Minister Nirmala Sitharaman tweeted that the agreement “marks a new chapter in India-US relations, opening immense opportunities for mutually beneficial cooperation.”

Agricultural Import Concerns Persist

Despite government assurances, concerns persist given statements from US officials. American Agriculture Secretary Brooke Rollins has claimed the agreement would boost US agricultural exports to India’s “vast market” and bring cash to rural America. She noted that in 2024, the US had a $1.3 billion agricultural trade deficit with India, which this deal aims to reduce.

US Trade Representative Jamieson Greer had previously stated that while progress was made, some elements including “agricultural market access” remain under discussion. Reuters reported that India may have agreed to partially open its tightly regulated agriculture sector, though details remain unclear.

Prime Minister Modi had earlier stated after the US imposed 50 percent tariffs in August 2025 that India would “never compromise” on the interests of farmers, livestock rearers, and fishermen, even if it meant paying a “heavy personal price.” This makes the current deal’s agricultural provisions particularly sensitive politically.

Expert Analysis

Market analysts remain cautiously optimistic but acknowledge sustainability depends on earnings recovery. The October-December quarter (Q3FY26) earnings for BSE Sensex companies has been the weakest in five years, with trailing EPS up just 1.3 percent year-on-year.

“While the near-term market reaction is understandably sharp, sustainability will depend on execution, sector-specific uptake, and whether earnings upgrades follow,” said Sonam Srivastava, founder and fund manager at Wright Research PMS.

Emkay Global suggested a Nifty target of 29,000 for 2026 end, anticipating strong FPI buying following reasonable valuations and earnings recovery. The brokerage identified SRF, Navin Fluorine, Gujarat Fluoro, Aarti, and Atul in chemicals; Gokaldas and Welspun Living in textiles; and Suprajit, Bharat Forge, and Sona Comstar in auto ancillaries as potential beneficiaries.

However, analysts also noted potential negative impacts on oil marketing companies and Reliance Industries if India stops buying Russian crude as committed.

Deal Highlights:

- US tariff on Indian goods reduced from 50% to 18%

- India commits to $500+ billion purchases of US products

- Agreement to reduce purchases of Russian oil

- Stock market surge: Sensex +2,072 points, Nifty +639 points

- Government denies compromise on farmer interests

- Opposition alleges betrayal of agricultural sector